HISTORIC, CURRENT, ESTIMATED AND EXPECTED ANALYSIS OF THE WORLD MARKET

The supercaps (SCs), also known as ultra-capacitors or electrical double layer capacitors, are energy storage devices with higher performance (in terms of energy density and power) than traditional capacitors. Moreover, the supercaps can receive and provide energy faster than the batteries and they have a longer average lifetime than the latter.

The SC can be favorited compared to the batteries for applications that need a fast and often charged/discharged system, without suffering significant wear.

The world market of the SC was valued at 15,850.5Mn US$ in 2018 and the market projection shows a compound annual growth rate (TCCA) of the 13.4% from 2019 to 2027, reaching an overall value of 5,628.1Mn US$ in 2027.

The economic development of the supercaps will be mainly driven both by the technological development of the regenerative braking system for hybrid and fully electric vehicles and by development of the integrated storage systems (supercaps – batteries) for the energy storage generated from renewable sources (especially wind and solar source).

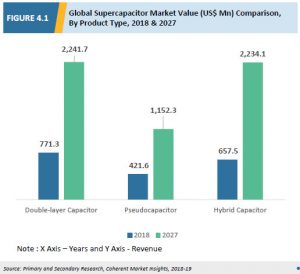

- Storage technology:

Among the various SCs storage technologies, the sector of the electrical double layer capacitors (EDLC) has a dominant position in the market. This sector was valued at 771.3Mn US$ in 2018 and is expected a TCCA of the 12.8% until 2027, reaching a total value of 2241.7Mn US $.

Moreover, the sector with the most TCCA (2018-2027) is characterized by hybrid supercaps. Its estimated TCCA is of the 14.8%, reaching a total value of 2234.1 Mn US $ in 2027.

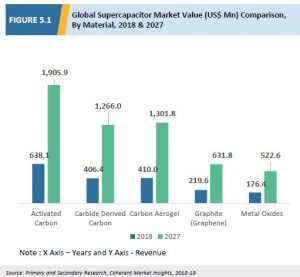

- Activated materials (electrodes):

Among the various activated materials for SC, the sector of activated carbon has a dominant position in the market. This sector was valued at 638.1Mn US $ in 2018 and is expected a TCCA of the 13.2% until 2027, reaching a total value of 1905.9Mn US $.

Moreover, the sector with the most TCCA (2018-2027) is characterized by carbon aerogel. Its estimated TCCA is of the 13.9%, reaching a total value of 1301.8 Mn US $ in 2027.

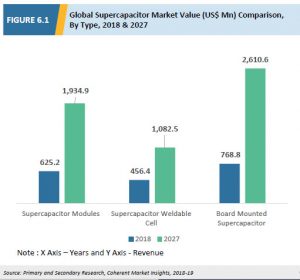

- Product typology:

Among the various product typology, the sector of the supeercas which can be equipped on the board mounted has a dominant position in the market. This sector was avlued at 768.8Mn US $ in 2018 and is expected a TCCA of the 14.8% until 2027, reaching a total value of 2610.6Mn US $.

Moreover, this product typology represents also the sector with the most TCCA (2018-2027) for the analysed period.

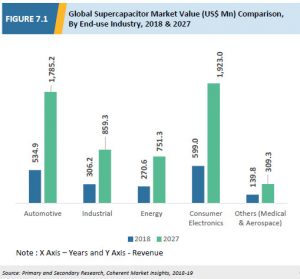

- Industry typology:

Among the various industries that use SCs, the sector of the electronic devices has a dominant position in the market. This sector was valued at 599.0Mn US $ in 2018 and is expected a TCCA of the 14.1% until 2027, reaching a total value of 1923.0 Mn US $.

Moreover, the industrial sector with the most TCCA (2018-2027) is represented by automotive, which was estimated with a TCCA of the 14.6%, reaching a total value of the 1843.1 Mn US $ in the 2027.

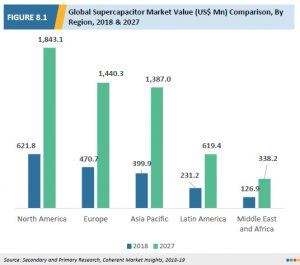

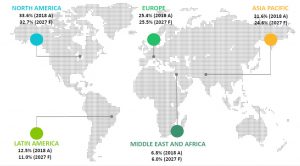

- Market regions:

Among the various market regions, the Noth America has a dominant position in the market. This sector was valued at 621.8Mn US $ in 2018 and is expected a TCCA of the 12.9% until 2027, reaching a total value of 1843.1 Mn US $.

Moreover, the market region with the most TCCA (2018-2027) is represented by Asia, which was estimated with a TCCA of the 15.2%, reaching a total value of the 1387.0 Mn US $ in 2027.

Growing public concern about the climate change and the global warming is driving the increase of the electric vehicles number (hybrid and/or fully electric) then they allow to reduce the greenhouse gas emissions.

These vehicles with electric engines have a better efficiency and lower maintenance costs than the traditional thermal engines (petrol and diesel). Moreover, the current development policies on mobility of certain governments tend to contain, with government incentives for buyers, the current economic gap of the production cost of the vehicles with thermal engine (cheaper) compared to the electric engine (more expensive).

E.g. According to the “Edison Electric Institute”, overall sales of the electric vehicles from 2017 to 2018 in USA are increased of the 40%.

The braking technology of the electrical vehicles consumes much energy during the braking and a part of this energy is dissipated in the form of heat, reducing the efficiency and the battery life. This problem can be solved using a regenerative braking system; in this braking system the kinetic energy of the wheels is converted back into electricity and is accumulated in the batteries or capacitors. This system has been improved using storage systems like the fly-wheels, DC-DC converter and SCs.

According with the Journal of Creative Research Thoughts (IJCRT), the use of these systems allows a total increase from 8% to 25% of the accumulated energy management efficiency.

In addition to the general energy advantages, regenerative braking systems have better resistance wear and performance than those traditional ones, especially in Stop&Go situations (urban traffic).

The growing demand for electric vehicles and the increase of electric engines efficiency coupled to regenerative braking systems can be a motive force for the development of SCs market.

The SC are also used like energy storage in industrial and commercial applications.

Often, in the commercial applications, the SCs are integrated with the batteries increasing energy storage capacity. These systems are known as hybrid energy storage systems (HESS). This systems can reduce charging time and equivalent series resistance (ESR), making them attractive, especially in the renewable energy sector.

Moreover, the HESS systems have a lower environmental impact than the single use of the batteries and SCs. In fact, because of a synergic effect of energies and powers management, the HESS can increase the average life (life cycles) of both batteries (primary storage) and SCs

SCs have a lower energy density and higher costs than lithium-ion batteries. In fact, for the same size, a SC can’t accumulate energy like a conventional lithium-ion battery. Moreover, for the same energy, the SC sizes are greater than a lithium-ion batter, increasing the production costs.

The strength of the SCs is the higher power density than a conventional lithium-ion battery.

Because of their versatile production and low charging times, the SC are suitable for developing of wearable devices that are an opportunity for the high-tech market.

Other SC applications are mobile telephone, computer, laptop, communication devices, security systems, photovoltaic systems, smart meter and power back-up for the protection of electronic devices from discontinuous current outputs. The power back-up is also suitable for developing and protection of nanogrids and microgrids, managing power outages or power peacks, avoiding damage to electronic devices.

WORLD MARKET ANALYSYS: STORAGE SYSTEM

The EDLC for 2018 occupied the largest part of the market with 41.7% with US$771.3Mn and is expected to have a TCCA of 12.8% by 2027 reaching a total value of US$2241.7mn.

Hybrid SCs are the industry with the highest relative growth (2018-2027) and was estimated to have a TCCA of 14.8% for total value in 2027 of 2234.1 Mn US $.

A hybrid SC is termed asymmetrical in that it has both electrostatic and electrochemical capacity, an example being the Li-ion capacitor (LIC).

Hybrid SCs accumulate charge and energy both by non-faradic/electrostatic processes (distribution of charges on the surface) and by faradic processes (electrode/electrolyte charge transfer), for this reason such devices are able to obtain higher energy densities and power than EDLC.

Pseudocapacitors represent the smallest market section and with a lower average annual growth. They are based on both electrostatic charge accumulation and reversible redox reactions on the electrode surface. This process is obtained through electro-adsorption, redox reactions and intercalation, such phenomena give rise to what is called pseudo-capacity. This mechanism allows for better performance than the EDLC, but costs are affected (the most used materials are ruthenium oxide and manganese) and the average life of the device.

WORLD MARKET ANALYSIS: MATERIALS

Based on the materials, the CS market is divided into active carbon, carbide-derived carbon, aerogel carbon, graphite (graphene) and metallic oxides.

The active coals for 2018 achivied the most of the market with 34.5% with 638.1Mn US $ and is expected a TCCA of 13.2% in 2027 reaching a total value of 1905.9Mn US $.

Carbon aerogels are the industry with the highest relative growth (2018-2027) and was estimated to have a TCCA of 13.9% for total value in 2027 of 1301.8 Mn US $.

Many coal-based materials are used with active material for EDLC electrodes, such as coal dust, carbon fibres, carbon moliths, carbon aerogel, carbon templates, carbons from carbides, carbon nanotubes and graphene.

Activated charcoal is the most widely used due to its high surface area and its low cost and ease of preparation. Other carbonaceous materials such as graphite, carbon black, graphene and carbon nanotubes are used as additives (5-10% w/w) to increase the conductivity of the electrode and thus the overall efficiency.

The carbons deriving from carbides (Carbide Derived Carbon – CDC) are also known as modular porous carbons, because of their nature it is possible to control the distribution of micropores, mesopori and macropori according to the crystalline structure of the solid. Thanks to this technology it is also possible to design hierarchized coals (hierarchical carbon) that provide a non-random distribution of pore size but structured in order to facilitate the access of ions inside the electrode (more foreign pores with larger size, more internal pores with smaller size) increasing the performance of the device.

Carbon aerogel consists of a three-dimensional network of carbon in the nanometer size. It has a high conductivity and the possibility of being produced according to the specific needs of the device you want to build. This material has a very homogeneous structure and spherical cavities in when it is produced by emulsion polymerization.

Graphene-based Sccs have the highest specific surface area compared to activated carbon, thanks to their particular efficiency and properties can be used for the development of transparent devices for energy storage in the photovoltaic sector.Other applications with higher added value are the drug delivery (electronic pharmacological delivery devices) and biosensing (electronic devices for monitoring specific physiological parameters). For graphene-based devices charge densities of 550 F per gram can be achieved (EDLC devices on activated carbon reach 150 F per gram).

Metal Organic Frameworks (Metal Organic Frameworks – Mofs) are widely used for their porous structure and high surface area which is absent in common porous metal oxides.

Recently, electrodes based on Mofs structures have been developed and patented by Lamborghini in collaboration with Massachusset Institute of Technology (MIT) in Boston (USA).

WORLD MARKET ANALYSYS: PRODUCT TYPES

Based on product types, the SCs market is divided into SC modules, SC cells e board mounted SC. In 2018 the SC board mounted the most of the market with the 33% with 768.8Mn US $ and a TCCA of 14.8% is expected no later than 2027, reaching a total value of 2610.6Mn US $. Moreover, this sector is growing more (2018-2027).

In a SC module a great number of SC cells can be connected in series and/or in parallel: the connections in series are used to reach the desired voltage (the single cells have usually a voltage of 2.5-2.8V), however the connections in parallel can be used to achieve needed specific capacitance, energy and power. The SC modules are used in the energy storage sector, power back-up applications, current peack management, heavy machineries, automotive, UPS for utilitygrid, nanogrid e microgrid.

The SC board mouted are mounted on printed circuit board (PCB) and provide an useful platform to balance the high voltage SC with a low voltage control method, low leakage and current.

Moreover, the PCB are scalable by growing market demands for high voltage systems.

WORLD MARKET ANALYSYS: DOWNSTREAM USERS

Based on industrial use, the SCs market is divided into electronic devices, industry, automotive, energy and others like medical and aerospace sector.

In 2018 the electronic devices achieved the most of the market with the 32% with 599.0Mn US $ and a TCCA of 14.1% until 2027, reaching a total value of 1923.0 Mn US $.

However, automotive is the sector with the higher relative growth (2018-2027) and is expected a TCCA of the 14.6% for a total value of 1843.1 Mn US $ in 2027.

The SC and hybrid SC have a fondamental role in industrial applications, automated guided vehicles, cranes, Internal combustion engines (ICE)

SC e SC ibridi svolgono un ruolo fondamentale per applicazioni industriali per macchinari da lavoro (heavy-duty machine), veicoli a guida automatica (automated guided vehicles), gru, motori con combustione interna (Internal combustion engines – ICE) prolonging the average life of batteries system and decreasing the charging times.

In the automotive the use of SC dominates especially the regenerative braking systems and acceleration power boost for electric engine.

In the renewable energy sector, the SC are used as reserve power supplies for wind turbine pitch control system. This function is not always possible with the power batteries. The SC are also used in the solar energy sector, in fact the demand of SC integrated in photovoltaic panels is growing, thus they can be efficient also at low voltage.

In the medical sector the use of SC is growing because of the demand of the implantable medical devices, however in the aerospace sector they are demanded especially for developing low weight devices and that preserve their performance also with low temperature.

WORLD MARKET ANALYSYS: GEOGRAPHICAL DISTRIBUTION

Based on economic areas the SCs market is divided into North America, Latin America, Europe, Middle East and Africa and Asia Pacific.

In 2018 the North America achieved the most of the market with the 32.7% with 621.8Mn US $ and is expected a TCCA of the12.9% until 2027 reaching a total value of 1843.1 Mn US $.

However, the Asia Pacific is the sector with the higher relative growth (2018-2027) and is expected a TCCA of the 15.2% with a total value of 1.387.0 Mn US $ in 2027.

In North America the growing demand of the SC depends on a high number of production companies in the automotive sector, a high consumption and production of the electronic device and the growing aerospace and renewable energy sectors.

According to the International Renewal Energy Agency (IRENA), in the USA in 2010 the renewable energy was the 7.5% of the total energy and is expected the 27% no later than 2030, that drive the growing of the SC market in North America.

Moreover, also in Canada the energy policies are encouraging the renewable energy. In May 2016 the Federal Court of Appeal announced that all diesel fuel sold, produced or imported into Canada hould contain 2% renewable fuel.

Is expected that the SC Europen market will be driven in growth by the automotive industry because of major manufacturers like BMW, Volkswagen, Peugeot and FCA (the latter two recently embarked on the path of fusion).

According to the Germany Trade and Invest Institute (GTAI), in Germany are invested more than 28 million US $ in the R&D area of the atumotive sector in the period 2018-2019.

Is expected that the Asia Pacific market grow faster in the period 2018-2027. For example, according to Indian Brand Equity Foundation (IBEF), the export of electronic devices in India reached US$245.1Mn in the period April-November 2017, and the electronics market in India is estimated to reach US$400 billion in 2020.

In emerging economies, such as China, the sale of electric or hybrid vehicles is growing, and demand for SCs in the Asia Pacific sector is expected to increase significantly. For example, according to the International Council on Clean Transport, in 2017 China was the largest manufacturer of electric vehicles. In 2017, Chinese manufacturers produced 50% of the world’s electric vehicles.

In Latin America there are several socio-economic factors that are expected to be driving force for the development of the SC market, among which we can list: a rapid industrialization, a positive demographic trend and increasing urbanization, the growth of the luxury and comfort goods market, technological innovation and increases in the sale of electronic devices.

The rapid growth of the electronic sector in Mexico will lead to growth in foreign investment, which will foster the development of the Latin American economy. For example, Panasonic invested $22.8mn in Tijuana (Mexico) to develop a new production point. In Mexico, companies are more focused on the production and development of telecommunications systems and related consumer goods (network signal coverage, mobile phones, screens, televisions), also leading to a development of the SC market.

In South Africa, the telecommunications industry is one of the fastest growing and most developing, bringing an increase and improvement in the connection network. For example, according to the United Nations Africa Renewal Institute, the percentage of mobile phone owners in Africa rose from 2% in 2000 to 53% in 2011. In this context, the UPS networks are in strong development, leading to an increase in the CS market.

GLOBAL MARKET ANALYSIS: COMPANY PROFILES

Announcements of new potential SC models (even if at a stage earlier than the prototypical one) are published almost monthly and often concern companies working in the automotive sector or smartphones for the specific and immediate inclusion in their sector. For example, in 2016 a group of researchers from the University of Central Florida announced a new type of cell phone battery; such a battery is actually a supercondensator that uses unidimensional and two-dimensional rare earth metal structures to allow (in theory) the realization of cell phones that can be recharged in seconds. At the moment they are still in an experimental phase and there is no analysis of the commercial practicality of such objects, as well as in other news on mobile phones that could be recharged in a few seconds.

Excluding these cases, the companies that make SC their main goal are relatively few so we can deepen them, also because there have been important changes in the last 3 years. The main manufacturers of supercapacitors are Maxwell Technologies (purchased in 2019 by Tesla), Panasonic, Nesscap (purchased in 2017 by Maxwell), LS Mtron (a unit of LS Cable), Supreme Power Solutions (SPS CAP), Vina Technology Company, Samxon (a unit of Man Yue Technology Holdings), Skeleton Technologies, Yunasko and Ioxus.

In the field of batteries, the competition can concern only the plans in the longer term, because in this historical phase the comparison takes place between different companies of the same type of energy storage because of the strong difference in performance and therefore in applications. An exception may be Toshiba. Toshiba Corporation is a multinational Japanese corporation with headquarters in Tokyo. It has developed a lithium titanate battery that has a lifetime in terms of charge and discharge cycles higher than an order of magnitude to the most common lithium batteries, they also have a higher power but are not yet comparable in this to supercapacitors and incorporate one fifth of the energy of current batteries. For their greater convenience on electric vehicles, such batteries must be counted among the potential competitors of all manufacturers of supercondensators.

Returning to the current manufacturers of supercapacitors, the main specialist until 2018 was represented by Maxwell Technology. Maxwell is headquartered in San Diego (California) and also deals with switches and voltage detectors. It is aimed at car manufacturers, renewable energy suppliers, wireless communications and the fields of electronic applications in general. Outside the United States, it has an office in Germany, one in Switzerland, one in China and one in South Korea, but overall it employs 367 employees. Maxwell’s supercapacitors are divided into two categories, those with shapes and sizes similar to common batteries and those similar to car batteries that reach up to 160 V.

In April 2017, Maxwell incorporated another supercapacitor company, Nesscap, which had its headquarters in Giheung-gu (South Korea) and other offices in Canada, the USA, China and Germany. As with Maxwell, Nesscap catered to companies ranging from portable electronics to automotive and green economy. They also produced supercapacitors in the form of small 3.0 V cylinders as well as modules up to 125 V. The Panasonic Corporation is the well-known Japanese electronics multinational, which as many know deals mainly with cameras, mobile phones, TV screens and some simpler products such as fans and headphones. It also produces supercapacitors, but only in the form of discs and cylinders, arriving at modules with a maximum voltage of 15 V on 5 euros. In this case, supercapacitors are applied as power support devices and for memory backup, then as accessory devices of electronic applications. LS Cable & System is an industrial corporation that deals with cables and telecommunications systems; it is headquartered in Anyang, South Korea. As already mentioned, the LS Mtron is a unit of the LS Cable & System that in turn works in a wide range of sectors (tractors, electronic components, copper sheets, etc.) including notes supercondensators. In this case, LS Mtron targets both hybrid vehicle manufacturers and train manufacturers, as well as the wind and solar energy sector. As with Maxwell, this company produces both supercapacitors in the form of cylinders and modules up to 130 V. The Supreme Power Solutions Company is a company based in Beijing and factories in Ningbo and Changzhou, specializing in supercapacitors, so it is abbreviated to SPSCAP. With the acquisition of Maxwell by Tesla, SPSCAP is now the world’s leading supercapacitor company. Again, its users are manufacturers of electric and hybrid vehicles in addition to renewable energy suppliers (not excluding wind). In addition to the subdivision of their products into cylinders and cells from 2.7 – 5.0 V and modules that reach up to 144 V, the SPSCAP also provides a superior structure of multiple modules that they call systems. With the systems they do not just go from 500 to 1500 V, but also customize additional functions such as setting uploads and various monitoring options. Vina Technology co. is another South Korean company specialized in supercapacitors, but in this case the modular structures produced so far reach 6.0 V.

Samxon is a Chinese brand that deals with supercapacitors of small scale and with the capacity of the order of Farad, that is, even if they are electrolytic capacitors, they are not comparable to those that constitute the object of our investigation. Another important company is the European company Skeleton, born in Estonia and based in Germany. The supercapacitors it produces are the only ones to use as electrode material the so-called “curved graphene”, a material with a specific area higher than that of the most common activated carbon. They produce supercapacitors in modules that operate at a voltage of 350 V. However, they produce SC more expensive than those that supplied Maxwell and that sells SPS CAP and their turnover is at the moment that of a medium-sized enterprise. Yunasko Ltd was founded in London, but also has offices in Ukraine and Latvia. It deals only with supercapacitors and boasts to realize them with the maximum specific power among the main manufacturers, Maxwell and LS Mtron included. Yunasko manufactures individual cells and modules, which however reach up to 16 V. Yoxus co. is based in Oneonta, New York. It offers the same basic range of all supercondensator companies, that is, it supplies single cells and modules structures, the latter reaching a maximum of 162 V. On request, as for other companies, They can realize superior modular structures in order to be able to reach up to 2000 V, but always as for almost the totality of the producers, it does not have electronic boards for the management of the energy distributions. Nippon Chemi-Con is one of the oldest companies seen so far (founded in 1931, obviously in Japan). It has been mainly involved in the production of conventional capacitors, in addition to the relatively recent production of supercapacitors called EDLC (electrical double-layer capacitors). It currently produces supercapacitors in 2.7 V cells and 7.5 V modules. Another Japanese company to mention is JM Energy, which has developed a lithium-ion capacitor. The ULTIMATE model, which reaches 3.8 V and 3300 F, reaches one of the maximum energy density values (13 Wh/kg). As competitors dealing exclusively with supercapacitors we mention the following that produce products with performance similar to or lower than those of the former Nextscap. We have Illinois capacitor, Samwha and Korchip. These latter companies have more precisely good performance in terms of energy density, but with regard to cell-type supercapacitors. The most important companies discussed above, however, are those that present, perhaps with equal intrinsic properties, a greater range of products to offer customers. Outside the specialized companies, we point out the case of Elbit System, an Israeli company that deals with electronic defense systems. The sectors in which it enters are aerospace, land, naval, surveillance and intelligence, for example manufactures various models of drones. Very recently he developed a new type of supercapacitor based on an aqueous electrolyte that could be applied on electric buses.